2025 Consumers Demand Clarity: Be Premium, Be Valuable, or Be Forgotten

The post-pandemic consumer doesn’t want average—they want alignment. In 2025, shoppers are making intentional choices: they’ll either pay more for premium experiences or hunt down unbeatable value. The data is clear: off-price retailers and luxury brands are surging, while mid-market players are losing relevance fast.

Retail, dining, and entertainment trends all point to one truth—value perception now outweighs convenience, and brand clarity drives traffic. To thrive in this new landscape, your business must take a side. The middle? It’s disappearing.

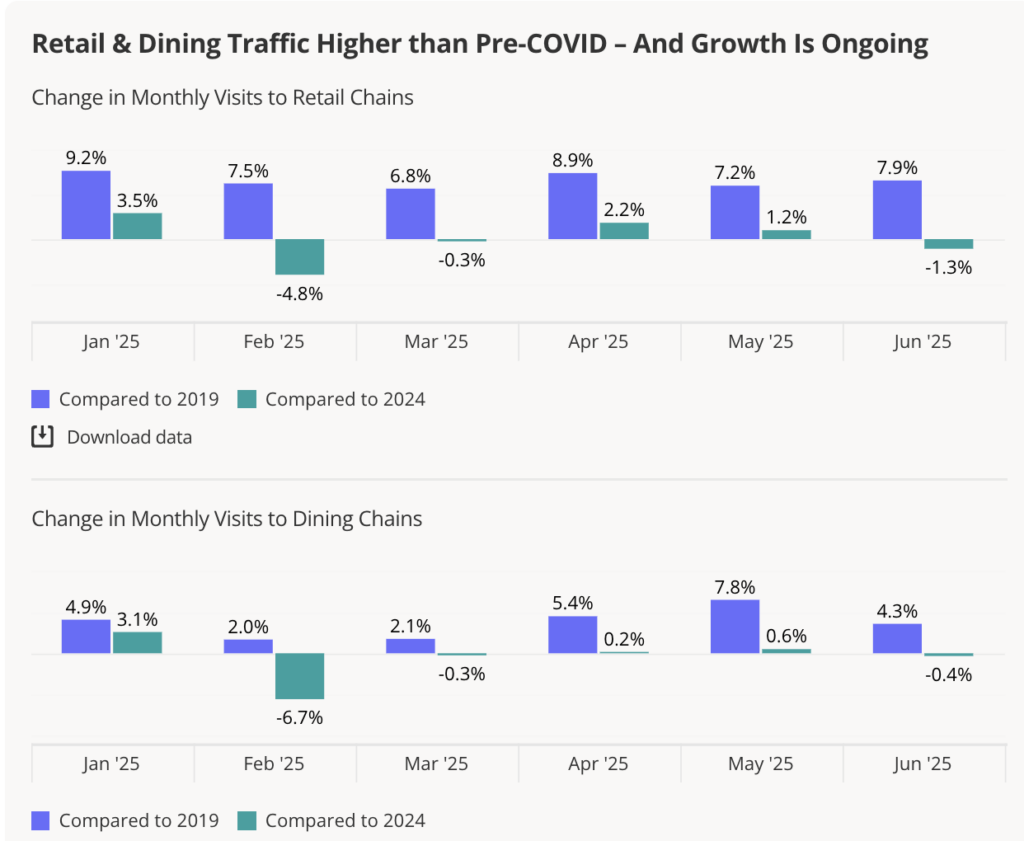

Retail Leads the Comeback—Dining Follows Close Behind

Consumer foot traffic is back—and then some. In 2025, monthly visits to both retail and dining chains now exceed pre-pandemic levels, but the scale and behavior differ between the two:

Retail chains are seeing a strong and sustained increase in visits. Consumers are no longer settling for one-stop-shops. Instead, they’re making multiple intentional visits to find the perfect mix of value, product quality, and brand experience. Leaders like Costco, Aldi, and Dollar General are thriving by delivering exactly what their audience values most.

Dining chains, while also experiencing growth, lag slightly behind retail. The winners—Chick-fil-A, Raising Cane’s, and Dutch Bros—succeed by owning a specific niche or delivering strong perceived value. But the average consumer is more selective now, favoring either affordable indulgences or premium, occasion-driven meals—leaving casual, mid-market dining chains struggling for relevance.

👉 The numbers don’t lie: value clarity and brand positioning are what drive traffic in 2025.

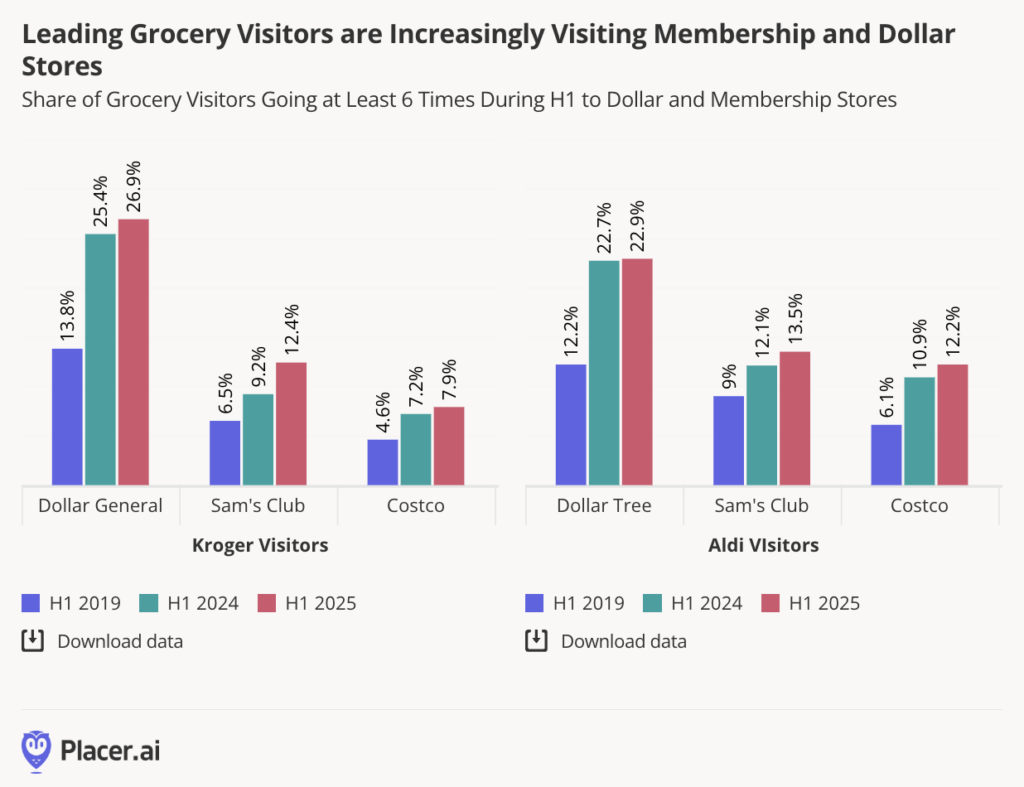

Cross-Shopping Is the New Normal: Value Chains Dominate the Grocery Run

Today’s grocery shoppers aren’t loyal to one store—they’re strategic. The data shows that visitors to major grocery chains are increasingly making additional stops at membership clubs and dollar stores, like Costco, Sam’s Club, and Dollar Tree.

Why? Because consumers are on the hunt for maximum value, even if it means multiple trips. Whether it’s grabbing essentials at a dollar store, bulk items at a warehouse club, or favorites at a traditional grocer, shoppers are creating their own optimized grocery journeys.

This cross-shopping trend signals a new kind of consumer mindset—intentional, price-sensitive, and brand-aware. To win in 2025, retailers must meet them with clear value, curated offerings, and flexibility.

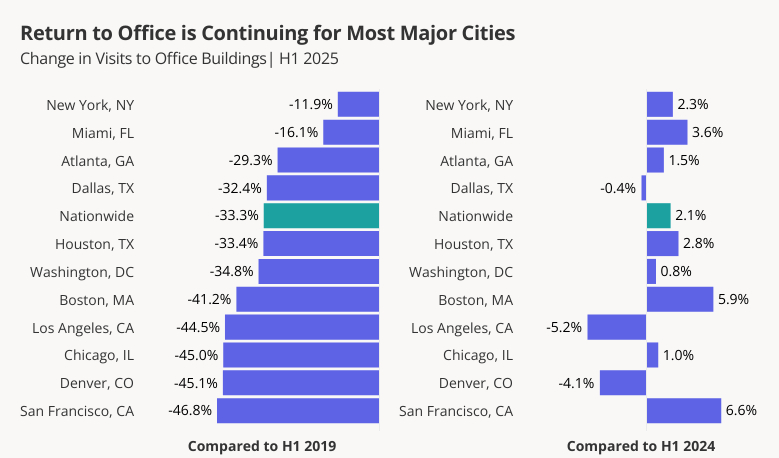

Return to Office Gains Momentum—But Full Recovery Still Distant

Office visits are slowly climbing back—but not all the way. In the first half of 2025, return-to-office efforts are showing traction in major cities, with places like New York and Miami posting YoY visit increases.

However, nationwide office traffic is still 33.3% below 2019 levels, indicating that hybrid and remote work models are here to stay. While mandates and in-person collaboration incentives are nudging employees back, the office ecosystem has fundamentally shifted.

For brands and service providers in urban business districts, this signals a slow but steady return of weekday foot traffic—but with a new rhythm and set of expectations.

Want the data behind the trends? Access the full Post-Pandemic Consumer Trends Report to discover what’s driving growth in 2025 across retail, dining, entertainment, and office sectors.

Know where your audience is spending

Uncover which segments are growing fastest

Align your strategy with what consumers value now

Fill out the form to get instant access.

© 2025 Clarovate. All Rights Reserved.